How to Fund Long-Term Care: A Comprehensive Guide to Insurance, Medicaid, and Smart Savings Strategies

Learn why long-term care is becoming a significant financial burden for retirees and how planning can help you manage the costs

As people live longer, the need for long-term care is growing rapidly. However, the costs associated with this care can be financially devastating if you’re unprepared. Long-term care (LTC) encompasses a wide range of services designed to meet medical and non-medical needs over an extended period, often during the later stages of life. According to Genworth Financial, the median annual cost of a private room in a nursing home exceeded $100,000 in 2023.

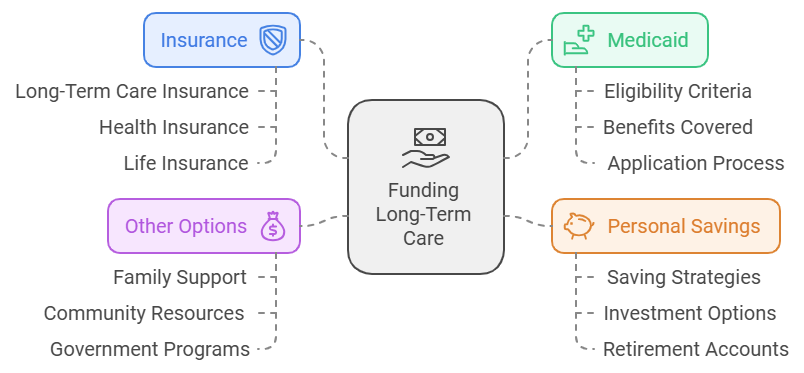

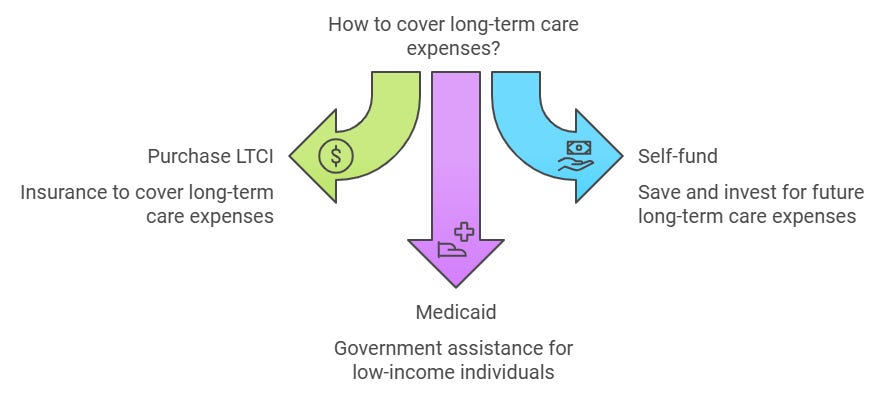

The big question remains: how will you fund these potentially staggering costs? This guide explores several options for financing long-term care, including insurance, Medicaid, personal savings, and more, to help you plan and make informed decisions.

1. Understanding Long-Term Care: What It Covers

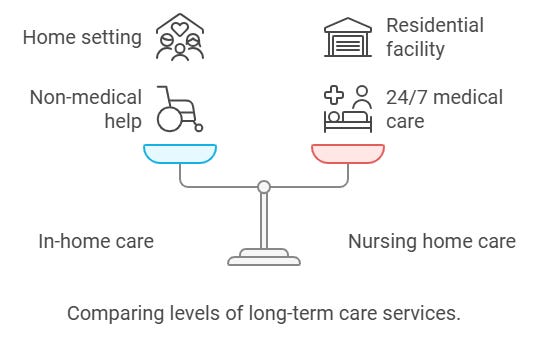

Long-term care includes various services designed to assist people with chronic illnesses, disabilities, or conditions that limit their ability to perform Activities of Daily Living (ADLs), such as bathing, dressing, or eating. The primary types of long-term care services include:

In-home care: Non-medical help such as personal care, homemaking, and, in some cases, skilled nursing.

Assisted living: Residential facilities that provide care, meals, and assistance with ADLs, but not intensive medical services.

Nursing home care: Facilities that provide a higher level of medical care, often 24/7, including skilled nursing, therapy, and medication management.

It’s important to note that Medicare generally does not cover long-term care unless it's rehabilitative in nature after a hospital stay. This leaves a significant coverage gap, making it critical to plan how to fund these services.

2. Insurance: Long-Term Care Insurance (LTCI)

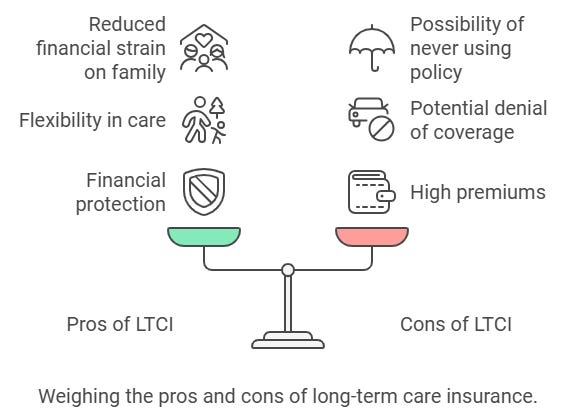

One of the most common ways to plan for long-term care expenses is by purchasing long-term care insurance (LTCI). LTCI can help cover the cost of care in a variety of settings, including nursing homes, assisted living facilities, and in-home care, but it’s essential to understand the pros and cons.

What is LTCI?

Long-term care insurance policies cover costs associated with extended care that aren’t covered by Medicare or standard health insurance. These policies typically cover a range of services, including in-home care, respite care, and stays in nursing homes or assisted living facilities.

Costs and Coverage

LTCI premiums vary depending on the age at which you buy the policy, your health, the level of coverage, and the specific benefits you choose. Policies typically include a daily or monthly benefit (the amount the policy pays out for care) and a benefit period (the length of time the policy will pay benefits). The American Association for Long-Term Care Insurance reports that the average premium for a 55-year-old couple is around $3,000 to $4,000 per year.

Pros: Long-term care insurance can protect your assets, provide flexibility in choosing care providers, and reduce financial strain on family members.

Cons: Premiums can be high, and insurers may deny coverage based on health conditions. Additionally, the policy may never be used if long-term care isn’t needed.

To compare LTCI policies and explore coverage options, visit trusted resources such as AARP’s Long-Term Care Insurance Guide.

3. Medicaid: Last-Resort Option for Long-Term Care

For those who cannot afford LTCI or personal care expenses, Medicaid can help cover long-term care costs, but only after strict eligibility criteria are met. Medicaid is the largest public payer for long-term care in the U.S., but it’s designed to be a last resort for people with low incomes or depleted assets.

Eligibility Requirements

To qualify for Medicaid’s long-term care coverage, you must meet both income and asset limits. These limits vary by state, but typically, you can have no more than $2,000 in assets (excluding your home, car, and a few personal items). Additionally, Medicaid requires that you "spend down" your assets to qualify, which can impact your estate and financial planning.

What Does Medicaid Cover?

Medicaid primarily covers nursing home care, but in some states, it also covers in-home care and assisted living. Medicaid coverage varies significantly by state, so it's crucial to check your state’s rules and coverage options on Medicaid’s official website.

Medicaid Spend-Down and Planning Strategies

Many individuals engage in Medicaid planning, which includes strategies like asset transfers or creating Medicaid-compliant trusts to protect some of their wealth while becoming eligible for Medicaid. It’s essential to consult a financial advisor or elder law attorney before attempting any of these strategies to ensure compliance with state and federal laws. Learn more about Medicaid planning.

4. Personal Savings and Retirement Funds

If you don’t qualify for Medicaid or have long-term care insurance, your personal savings and retirement funds may be your primary funding source for long-term care. This method requires careful planning to ensure your savings last throughout your retirement while covering care expenses.

How Much Should You Save?

According to Genworth Financial, the cost of long-term care can range from $50,000 to over $100,000 per year, depending on the type of care and location. To plan for these costs, experts recommend saving at least $200,000 to $300,000 dedicated to long-term care alone.

Using Retirement Accounts

Many retirees turn to their 401(k) or IRA accounts to fund long-term care, but this approach has tax implications. Large withdrawals from tax-deferred accounts can result in a significant tax burden, which may impact your overall savings strategy. Working with a financial advisor to understand how to balance your retirement income needs with potential long-term care expenses is essential.

Reverse Mortgages

A reverse mortgage can be another way to pay for long-term care by tapping into your home’s equity. This allows you to borrow against your home without having to sell it, providing cash flow to cover care costs. However, this strategy comes with risks, including the potential loss of home equity and the impact on your estate. Learn more from the Consumer Financial Protection Bureau.

5. Hybrid Insurance Policies: Life Insurance with Long-Term Care Riders

For those hesitant to purchase traditional LTCI, hybrid policies that combine life insurance with long-term care riders are gaining popularity. These policies allow you to use part of the life insurance death benefit for long-term care expenses while still ensuring that your beneficiaries receive some benefit if you don’t need extended care.

What Are Hybrid Policies?

Hybrid insurance policies combine life insurance with long-term care benefits. The long-term care rider allows you to access the death benefit early to cover care costs, which can help avoid the “use it or lose it” nature of traditional LTCI.

Pros and Cons of Hybrid Policies

Pros: The primary benefit is flexibility. If you don’t need long-term care, your beneficiaries still receive the death benefit. Additionally, hybrid policies tend to have simpler underwriting processes.

Cons: Hybrid policies often provide less long-term care coverage than traditional LTCI, and the premiums can be higher compared to standard life insurance policies.

For more information on hybrid insurance policies, visit Investopedia’s guide.

6. Veteran Benefits for Long-Term Care

Veterans may have access to long-term care benefits through the Department of Veterans Affairs (VA). These benefits can help cover the costs of nursing home care, assisted living, and in-home care for qualifying veterans.

Eligibility for VA Long-Term Care Benefits

To qualify for VA long-term care services, veterans must meet certain eligibility criteria, including having a service-connected disability or meeting low-income thresholds. Additionally, veterans who need assistance with ADLs may qualify for Aid and Attendance, an additional pension benefit.

What the VA Covers

The VA covers a wide range of long-term care services, including:

Nursing home care

In-home care services

Adult day health care

Assisted Living

For more details on eligibility and services, visit the VA's Long-Term Care Benefits page.

7. Employer-Sponsored Long-Term Care Plans

Some employers offer long-term care insurance as part of their benefits package. These employer-sponsored plans can be more affordable than individual policies and may offer group rates that lower the premiums.

What Are Employer-Sponsored LTC Plans?

Employer-sponsored long-term care insurance is a policy provided through your workplace. It typically offers lower premiums than individual plans. However, the coverage may be limited, and reviewing what’s included in the policy is essential.

Portability of Employer Plans

One key consideration is whether the LTC plan is portable — meaning you can take it with you if you change jobs or retire. Some plans allow you to continue coverage after leaving the company, but others may not. Be sure to understand the details of portability before enrolling.

8. Crowdfunding and Other Alternative Strategies

In recent years, crowdfunding has become a viable option for individuals and families who need help funding long-term care. While it’s not a guaranteed solution, it offers a way to raise money quickly when other funding options aren’t available.

How Crowdfunding Works

Platforms like GoFundMe allow individuals to create personal fundraising campaigns to cover medical and long-term care costs. Family members or caregivers can share these campaigns on social media, hoping to raise funds through small donations from a vast network of friends, family, and strangers.

Potential Drawbacks

While crowdfunding can be helpful, it comes with risks:

Uncertain outcome: There is no guarantee that you will raise enough money to cover your long-term care needs.

Privacy concerns: Sharing personal medical information publicly can feel invasive, and some families may not be comfortable with the exposure.

Platform fees: Some crowdfunding platforms take a percentage of the funds raised, reducing the overall amount received.

Other Alternatives

In addition to crowdfunding, local nonprofits or community programs may offer financial assistance or services for seniors needing long-term care. Check with local senior centers or Area Agencies on Aging for available resources. For more about these services, visit ElderCare.gov.

Conclusion: Plan Early to Secure Your Future Care

Planning for long-term care is essential to securing your financial stability and quality of life as you age. The earlier you start preparing, the more options you will have to manage the cost of care. Whether you opt for long-term care insurance, Medicaid, personal savings, or alternative solutions like hybrid insurance or VA benefits, understanding your options is the first step in creating a comprehensive plan.

By carefully considering the trade-offs and advantages of each funding method, you can protect your savings and ensure you have access to the care you need when you need it most. Speak to a financial advisor or elder law attorney to explore your situation's best long-term care funding strategies.

This article thoroughly guides funding long-term care, covering insurance, Medicaid, savings strategies, and alternative options. Remember to consult with a financial professional to ensure your long-term care plan aligns with your overall retirement goals.