Maximizing Health Savings Accounts (HSAs): A Step-by-Step Guide for Retirement Healthcare Expenses

Maximizing Your HSA for Retirement: A Complete Guide to Tax-Free Growth, Smart Contributions, and Long-Term Healthcare Savings

Healthcare costs are one of the largest financial burdens retirees face, with experts estimating that the average couple retiring at age 65 will need around $315,000 for healthcare expenses alone (Fidelity). Fortunately, a Health Savings Account (HSA) offers a robust, tax-advantaged way to prepare for these expenses. With the right strategy, an HSA can help retirees cover medical costs without depleting their savings, thanks to its unique triple tax advantage.

In this guide, we’ll explore how to maximize your HSA and strategically use it to cover healthcare expenses in retirement. We’ll dive into contributions, tax benefits, investment options, and more to help you maximize your HSA.

1. What Is an HSA and How Does It Work?

An HSA is a tax-advantaged savings account designed for people enrolled in high-deductible health plans (HDHPs). It helps cover qualified medical expenses by allowing tax-free withdrawals for healthcare costs. But the benefits of an HSA go far beyond short-term medical expenses—HSAs can also serve as a long-term savings vehicle for healthcare expenses in retirement.

Eligibility Requirements

To open and contribute to an HSA, you must be enrolled in a high-deductible health plan. For 2024, a high-deductible plan is defined as one with a deductible of at least:

$1,600 for individual coverage, or

$3,200 for family coverage.

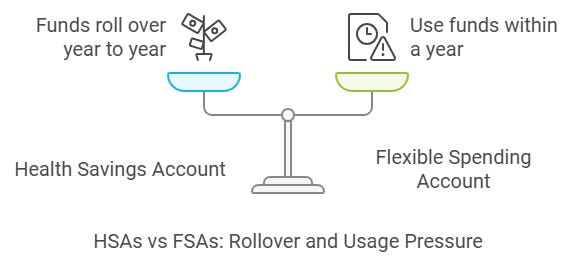

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, allowing you to accumulate savings without the pressure to use them within a specific timeframe.

Qualified medical expenses covered by HSA funds include:

Prescription drugs

Doctor visits and co-pays

Dental and vision care

Medical equipment (wheelchairs, etc.)

For a detailed list of qualified expenses, visit the IRS website. https://www.irs.gov/publications/p969

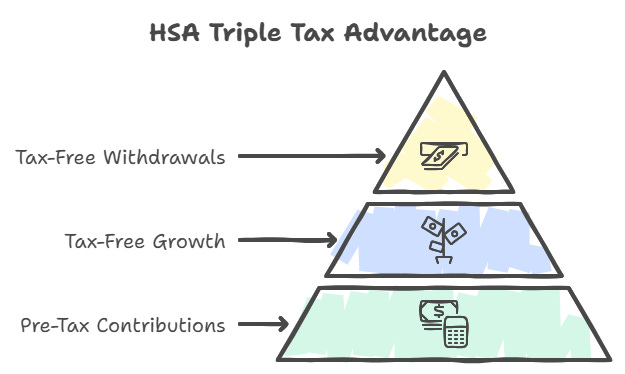

2. Triple Tax Advantage: The Key Benefits of an HSA

One of the main reasons HSAs stand out from other retirement savings options is their triple tax advantage. Here’s how these benefits break down:

Pre-Tax Contributions

When you contribute to an HSA, the money goes into your account before taxes. This reduces your taxable income for the year, which means you pay less in taxes. For example, if you contribute the 2024 maximum of $4,150 (for individuals) or $8,300 (for families), you’ll lower your taxable income by that amount.

Tax-Free Growth

Like a traditional IRA or 401(k), the money in your HSA can be invested, allowing it to grow over time. However, unlike other accounts, the investment earnings grow tax-free. This means that any dividends, interest, or capital gains earned in the account are not subject to taxes as long as the funds are eventually used for qualified medical expenses.

Tax-Free Withdrawals

Withdrawals from your HSA are tax-free if used to pay for qualified medical expenses. This offers more flexibility than a traditional retirement account, where withdrawals are taxed as ordinary income.

After age 65, you can use your HSA funds for non-medical expenses without facing a penalty, but these withdrawals will be taxed as ordinary income—similar to withdrawals from an IRA or 401(k).

For more information on the tax benefits of HSAs, visit Healthcare.gov's HSA page.

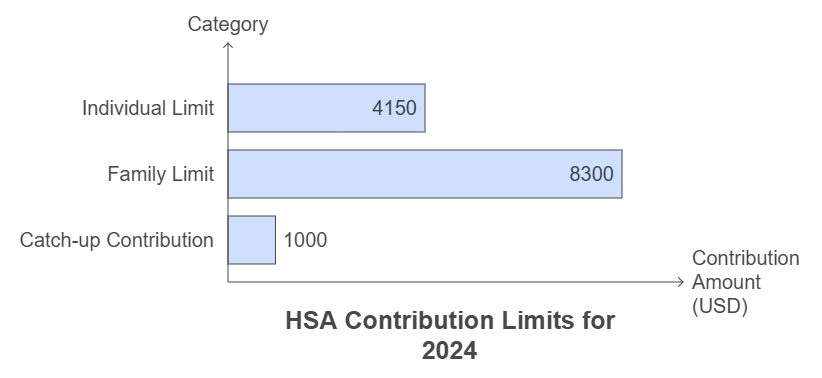

3. How Much Can You Contribute to an HSA?

The IRS sets annual contribution limits for HSAs, and understanding these limits is crucial to maximizing your savings. For 2024, the contribution limits are:

$4,150 for individuals, and

$8,300 for families.

Additionally, if you’re 55 or older, you can contribute an extra $1,000 per year as a "catch-up" contribution. This can significantly boost your HSA balance as you approach retirement, giving you more savings to cover future medical expenses.

Tip for Maximizing Contributions

To fully maximize your HSA, contribute the maximum amount each year. If your employer offers HSA contributions as part of your benefits package, take advantage of them, as these contributions do not count toward your individual limit.

4. Investing Your HSA for Long-Term Growth

One of the most overlooked benefits of HSAs is the ability to invest your contributions for long-term growth, similar to how you would invest in a 401(k) or IRA. By investing your HSA funds, you allow the balance to grow tax-free; over time, this compounding growth can significantly increase the funds available for healthcare expenses in retirement.

Investment Options

Many HSA providers offer investment options such as mutual funds, ETFs (Exchange-Traded Funds), and stocks. Like a standard investment account, you can choose investment vehicles based on your risk tolerance and financial goals.

For those who are younger and still working, a growth-focused portfolio can maximize long-term returns. As you approach retirement, consider transitioning to more conservative investments, such as bonds or money market funds.

Check with your HSA provider to see what investment options they offer. Some popular HSA providers with investment options include:

Fidelity: One of the most robust HSA platforms with a wide range of investment options.

HealthEquity: Known for easy-to-use investment tools.

5. Using Your HSA in Retirement: A Strategic Approach

When you reach retirement, knowing how to strategically use your HSA funds can help you stretch your savings further and avoid unnecessary taxes. HSAs can be used to cover a wide variety of healthcare costs in retirement, including:

Medicare premiums

Long-term care services

Prescription medications

Dental and vision care

It’s important to note that once you enroll in Medicare, you can no longer contribute to an HSA. However, you can still withdraw funds tax-free to pay for medical expenses like Medicare Part B and Part D premiums and out-of-pocket costs not covered by Medicare.

If you have substantial savings in your HSA, preserving those funds for major healthcare expenses like long-term care or unexpected medical emergencies may be beneficial.

6. Planning for Qualified Healthcare Expenses

Using your HSA efficiently means knowing what qualifies as a medical expense. The IRS provides a comprehensive list of qualified medical expenses, which includes:

Doctor visits and copayments

Prescription medications

Hospital stays and surgeries

Mental health services

Medical equipment

Dental care and orthodontics

Vision care, including eyeglasses and contact lenses

It’s crucial to keep detailed records of your medical expenses. By saving receipts, you can reimburse yourself tax-free from your HSA for medical costs, even if you delay reimbursement for years. This strategy allows your HSA to continue growing tax-free while ensuring you can access the funds when needed.

For the complete list of IRS-qualified expenses, visit the IRS Publication 502. https://www.irs.gov/publications/p502

7. Maximizing the HSA “Tax-Free Reimbursement” Strategy

One clever strategy to maximize your HSA’s long-term value is the tax-free reimbursement strategy. Here’s how it works:

1. Pay out-of-pocket for qualified medical expenses instead of using HSA funds immediately.

2. Save your receipts and let your HSA balance grow tax-free.

3. Reimburse yourself later (even years later), when you need the funds most, such as during retirement.

By delaying your HSA withdrawals, you allow more of your contributions to remain in the account, growing tax-free. This strategy can significantly boost your HSA balance, particularly if you have investment options within your account.

8. Comparing HSAs to Other Retirement Accounts: IRAs and 401(k)s

While HSAs are an excellent tool for healthcare expenses, it’s essential to understand how they compare to other retirement accounts like IRAs and 401(k)s.

Tax Benefits Comparison

HSAs: Triple tax advantage (tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses).

401(k) and IRAs: Tax-deductible contributions and tax-free growth, but withdrawals are taxed as income.

Healthcare-Specific Use

The critical advantage of HSAs is that they are designed specifically for medical expenses. Unlike 401(k)s or IRAs, which impose taxes on withdrawals, HSAs allow tax-free withdrawals for qualified healthcare costs.

For a comprehensive comparison, you can read Investopedia's guide to HSAs vs. IRAs.

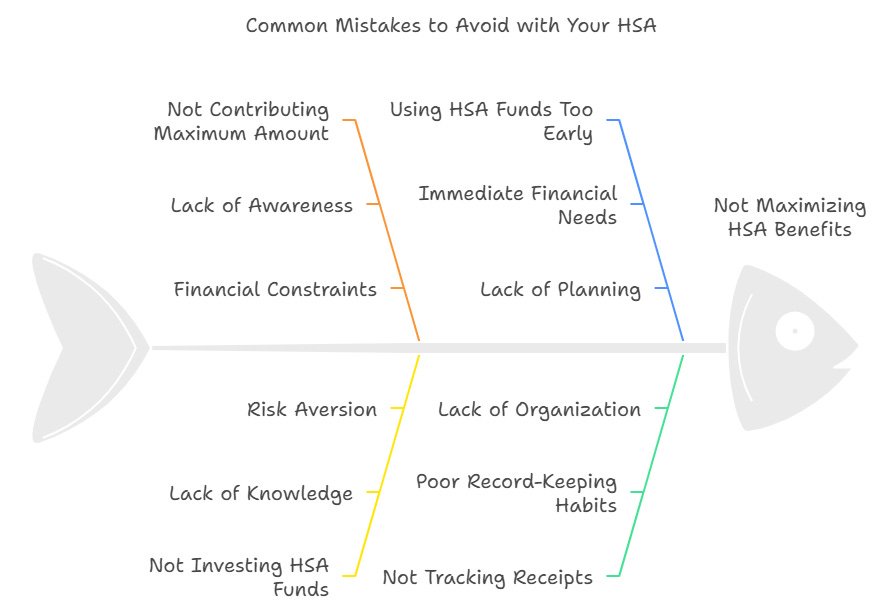

9. Common Mistakes to Avoid with Your HSA

Maximizing your HSA requires avoiding typical mistakes:

Not contributing the maximum amount: Missing out on tax savings and investment growth.

Not investing HSA funds: Keeping your HSA as a simple savings account limits long-term growth potential.

Using HSA funds too early: Using your HSA for minor medical expenses now can reduce the amount available for more significant expenses in retirement.

Not tracking receipts: Without proper records, you may miss opportunities for tax-free reimbursements.

Conclusion: Start Maximizing Your HSA Today

HSAs are one of the most versatile and powerful tools for covering healthcare expenses in retirement. By contributing the maximum amount, investing wisely, and utilizing strategic reimbursement, you can build a robust fund to cover both expected and unexpected healthcare costs.

Start maximizing your HSA today to secure your financial future. For more guidance, consult a financial advisor to develop a personalized HSA strategy that aligns with your long-term retirement goals.

This article provides a comprehensive, step-by-step guide to help you maximize your HSA for retirement healthcare expenses. To explore HSA options, consider visiting trusted providers like Fidelity and HealthEquity.

Maximizing your HSA is one of the most strategic ways to prepare for future healthcare costs, especially in retirement. By taking advantage of the unique tax benefits, contributing the maximum amount annually, and allowing your HSA to grow through investments, you can significantly reduce the financial burden that healthcare costs present in your later years.

If you're ready to optimize your HSA for retirement, consult a financial advisor to tailor an HSA strategy that fits your retirement goals and healthcare needs.