The Hidden Costs of Retirement Healthcare

Learn about the hidden costs of retirement healthcare and discover strategies to protect your savings from unexpected expenses, including Medicare gaps, long-term care, and inflation.

Many retirees are caught off guard by the staggering healthcare costs they face, often realizing too late that their savings may not be enough to cover unexpected medical expenses. Despite meticulous retirement planning, healthcare is frequently a silent budget killer. Fidelity Investments estimates that a 65-year-old couple will need about $315,000 to cover healthcare costs in retirement, excluding long-term care(FidelityInvestments).

This guide will uncover the hidden healthcare costs you need to consider and offer strategies to help you prepare for a financially secure retirement. Today’s newsletter is to bring these to your attention. Over the next few weeks, it will tackle how to plan for and avoid being surprised when you retire.

1. Medicare: More Gaps Than You Think

Medicare may seem like a safety net for retirees, but it doesn’t cover everything, leaving significant out-of-pocket costs for dental, vision, and long-term care costs.

Medicare Basics

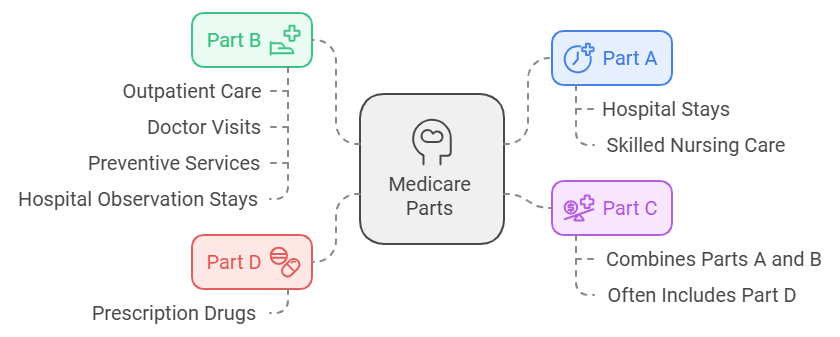

Medicare is broken into four parts:

Part A: Covers hospital stays and some skilled nursing care.

Part B: Covers outpatient care, doctor visits, and preventive services. It also covers Hospital Observation stays.

Part C (Medicare Advantage): An all-in-one plan that combines Parts A and B, and often Part D.

Part D: Covers prescription drugs.

While Medicare provides substantial coverage, retirees must still contend with premiums, deductibles, and copays. For example, Medicare Part B has a standard monthly premium, but retirees earning higher incomes may face Income-Related Monthly Adjustment Amounts (IRMAA), further increasing their healthcare costs(Fidelity Investments)(Kiplinger.com).

Medigap and Medicare Advantage

Many retirees turn to Medigap or Medicare Advantage plans to fill these gaps. However, these plans come with additional costs. Medigap helps cover out-of-pocket expenses not included in Original Medicare, but premiums vary. Meanwhile, Medicare Advantage plans offer broader coverage yet often have network restrictions and out-of-pocket limits that can catch retirees off guard.

2. Prescription Drug Costs: An Unavoidable Burden

Even with Medicare Part D, retirees often find themselves spending more on prescriptions than anticipated, especially for chronic conditions or newer, high-cost drugs.

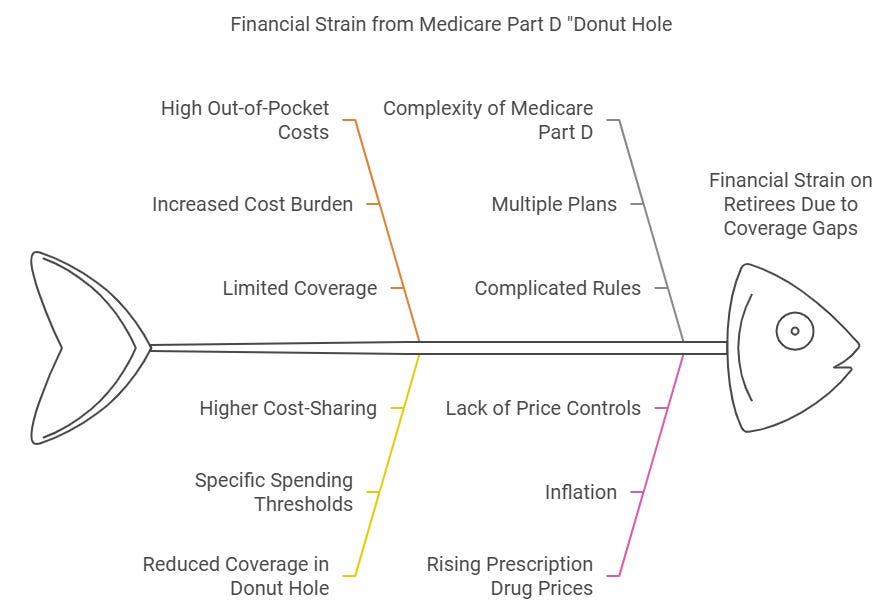

Medicare Part D Coverage Gaps

Medicare Part D helps manage prescription costs, but retirees may face coverage gaps. One of the most significant is the "donut hole," where once retirees and their drug plans have spent a certain amount on prescriptions, they must cover a larger share of the costs. While the donut hole has been reduced, it still exists and can cause financial strain(Fidelity Investments).

The Rising Cost of Medications

Prescription drug prices continue to rise faster than general inflation, particularly for specialty medications. Retirees with chronic conditions like diabetes, arthritis, or cancer may face thousands of dollars in out-of-pocket costs, even with Part D(Kiplinger.com).

3. Long-Term Care: The Elephant in the Room

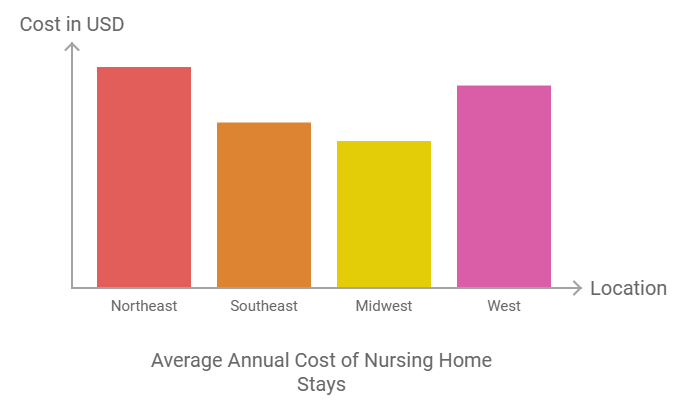

One of the most significant healthcare expenses that retirees often overlook is the cost of long-term care, whether in-home care, assisted living, or nursing homes.

Not Covered by Medicare

Medicare does not cover long-term care, leaving retirees to foot the bill for nursing homes, assisted living, or home healthcare. These costs can be substantial. For example, the average nursing home stay can exceed $100,000 annually, depending on location(Mercer Advisors)(Kiplinger.com).

Insurance Solutions

Many retirees look to long-term care insurance as a solution, but premiums can be expensive, and many applicants are denied coverage due to pre-existing health conditions. Hybrid life insurance policies that combine a long-term care rider with a death benefit are an alternative, but they, too, come with higher costs(Kiplinger.com).

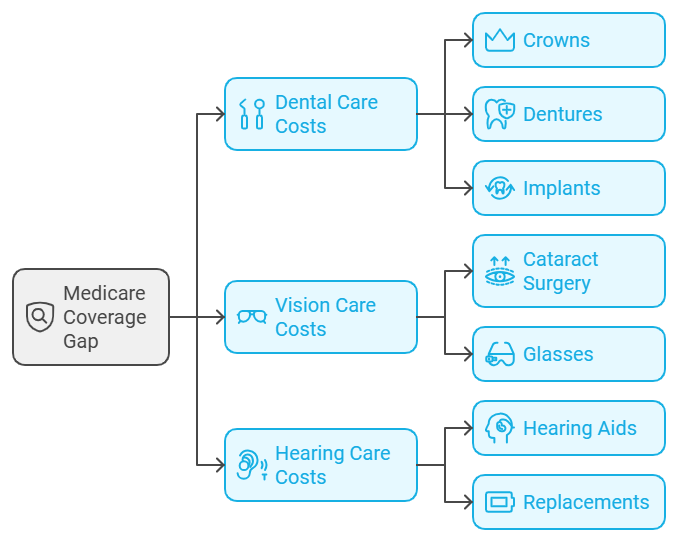

4. Out-of-pocket costs for Dental, Vision, and Hearing Care

Many retirees are shocked to discover that Medicare doesn’t cover routine dental, vision, or hearing care, resulting in unexpected bills.

The Cost of Dental Care

Dental procedures like crowns, dentures, and implants can cost thousands of dollars, but Medicare does not cover these routine dental services(Fidelity Investments). Many retirees must either purchase supplemental dental insurance or pay out of pocket.

Vision and Hearing Costs

Similarly, vision care (like cataract surgery or glasses) and hearing aids are often necessary as we age, but Medicare offers no coverage for these. The cost for hearing aids alone can be thousands of dollars, and replacements are typically needed every few years(Fidelity Investments)(Kiplinger.com).

5. Unexpected Medical Emergencies: Hospital Stays and Rehab

An unplanned hospital stay or rehabilitation period after surgery can quickly erode retirement savings, even with Medicare coverage.

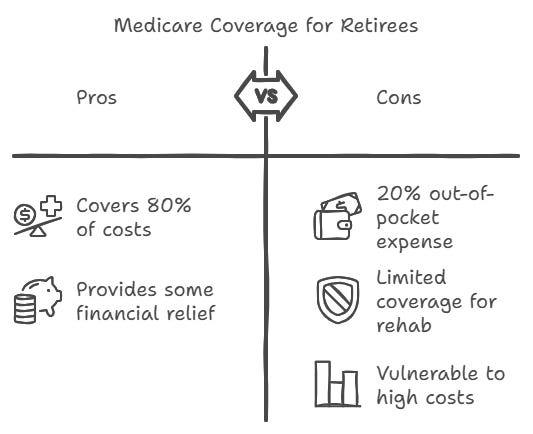

Medicare Coverage Limits

Medicare generally covers 80% of hospital and outpatient costs, but retirees are responsible for the remaining 20%, which can add up quickly during a lengthy hospital stay(Fidelity Investments). This leaves retirees vulnerable to significant out-of-pocket expenses, particularly for extended rehabilitation or skilled nursing care, which Medicare only partially covers(Mercer Advisors).

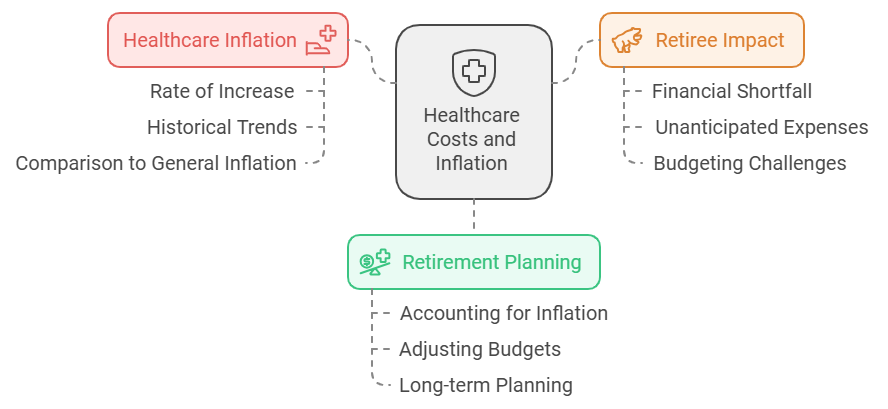

6. The Impact of Inflation on Healthcare Costs

Healthcare costs have historically risen faster than inflation, meaning retirees today may spend much more than they anticipated just a few years ago.

Rising Healthcare Inflation

Healthcare costs continue to rise faster than inflation, outstripping the modest increases retirees often budget for (Fidelity Investments). Failing to account for inflation when planning for retirement healthcare can leave retirees with a significant financial shortfall.

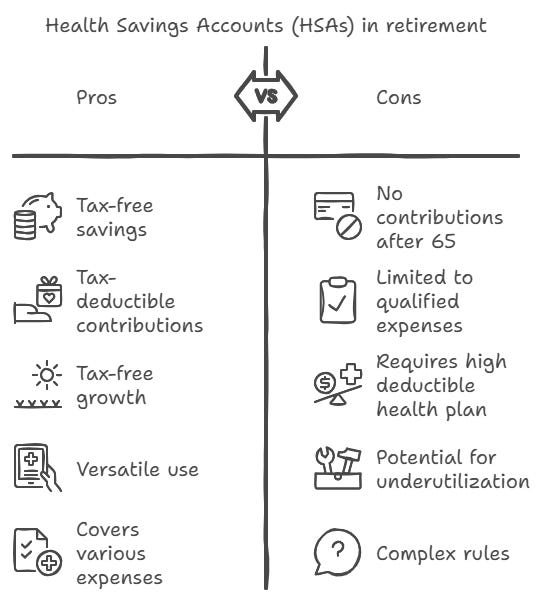

7. Health Savings Accounts (HSAs): Your Secret Weapon

One of the most effective tools for managing retirement healthcare expenses is a Health Savings Account (HSA), which offers unique tax advantages.

What is an HSA?

HSAs allow retirees to save money tax-free for qualified medical expenses. Contributions are tax-deductible, growth is tax-free, and withdrawals for healthcare costs are not taxed either(Mercer Advisors). This triple tax advantage makes HSAs one of the best tools for healthcare planning in retirement.

How to Use an HSA in Retirement

HSAs can be used to cover out-of-pocket expenses like Medicare premiums, prescription drugs, and dental care, making them a versatile savings vehicle. Retirees should contribute as much as possible before turning 65, as contributions are no longer allowed once Medicare enrollment begins(Mercer Advisors).

Conclusion: Plan Now, Avoid Surprises Later

While retirement healthcare costs can be daunting, early planning and understanding of hidden expenses can help protect your savings.

Understanding the hidden costs of retirement healthcare is the first step to safeguarding your financial future. By planning for Medicare gaps, rising prescription drug costs, long-term care, and inflation, you can ensure that healthcare doesn’t drain your hard-earned savings. Consider consulting a financial planner or utilizing tools like HSAs, Medigap, and long-term care insurance to protect yourself from the unexpected.

Over the following newsletters, we will dive deep into these hidden costs. We will get answers to the questions that bother you, insights into how to prepare and avoid unnecessary costs, and ways to stretch every dollar you have saved to cover these expenses as best as possible. If you are ready and prepared, you can withstand all the shocks that life may send your way.